Trade Setups Updated

Hi all, here are some updated trade setups I'm looking at. Lets start off with some shorts since I have been clear about general market direction being tilted to upside but these are the short focus.

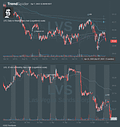

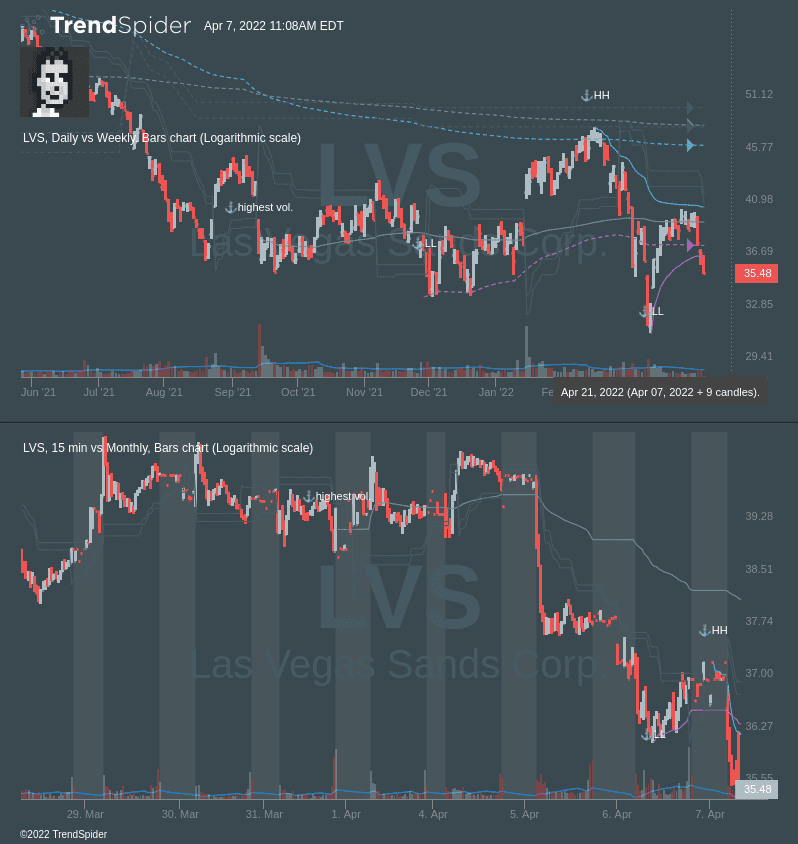

LVS - Nothing but bearish flow for the last two days on the options side. I think this can continue to break lower below the 30 handle.

Chart: https://share.…