There are still good setups. Here are the best ones we see.

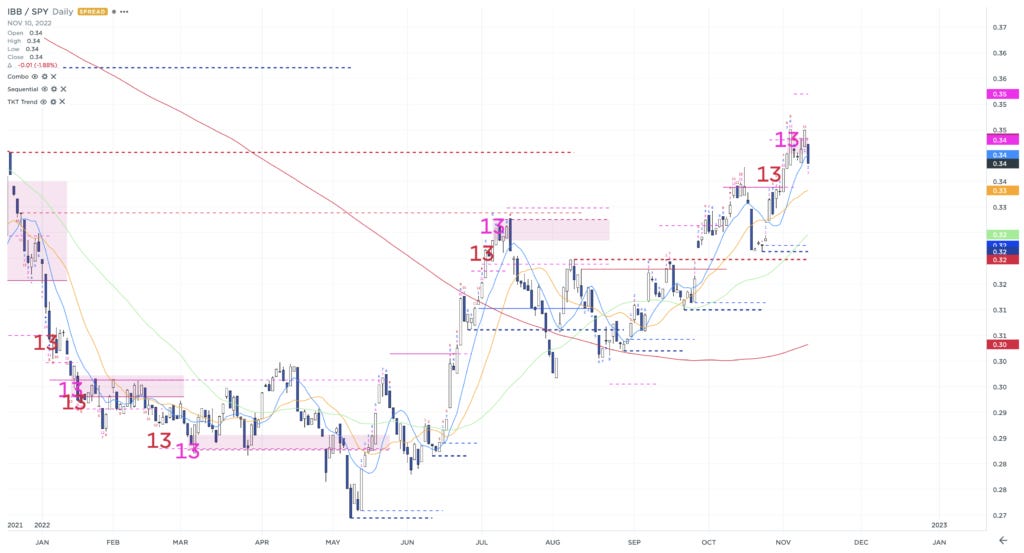

First, I think it's time to get out of the super large cap biotechs. AMGN has been leading to the upside along with names like GILD. However, if you look at the IBB/SPY ratio, we have clean sells and names like AMGN were actually weak in a 5%+ market... That is a big signal to me.

With real yields starting to back off a bit, there could be a strong move …