Thank you for all of the subscriptions.

Before we get into the bi-weekly setting...lets talk stocks and energy.

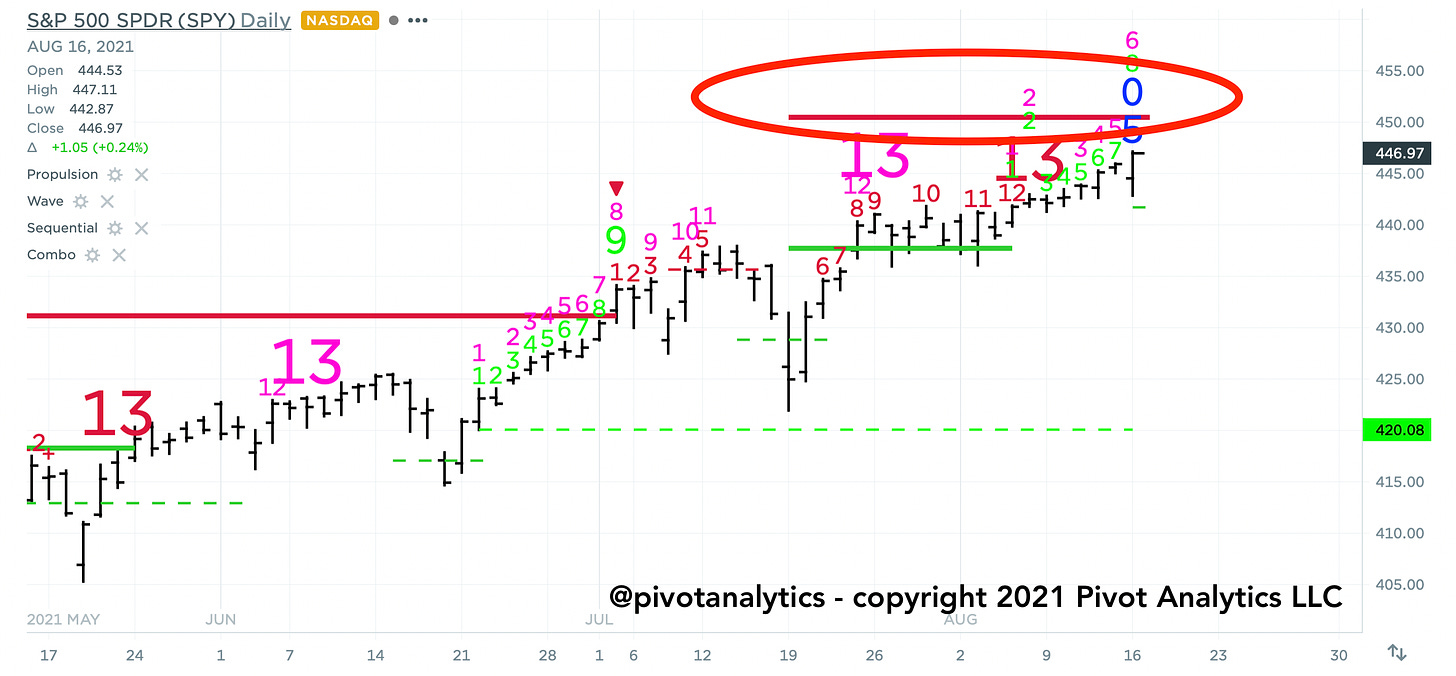

Let me share some charts with you.

First, a lot of chatter about market risk. This is a big lol to me. Markets have been gearing higher for decades now with TD Sequential / TD Combo 13’s all the way up. Don’t get me wrong, I use DeMark timing as a basis for most of my trades, but using 13’s to time the stock market is silly.

Instead, what I look at is the…