Stick with Quality: Doordash Example

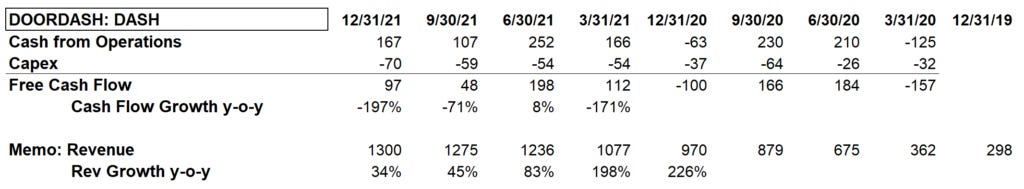

DoorDash (DASH), has built a nice business, but is it really worth $31 billion at $90 per share? Revenues and cash flows are a tale of two stories:

Revenues are growing nicely but cash flows are not. In general, tech companies can do well growing revenues at a loss, BUT, once they go profitable, tech companies need to have cash flow growth otherwise thei…