Speaking Technicals

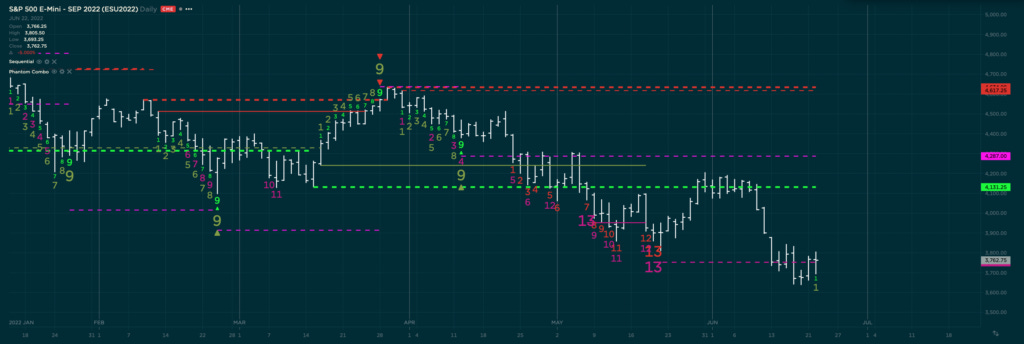

Emini S&P still holding down the risk levels we are looking at near the monthly range projection lows. We are still looking for the upswing from here on homerun size.

Why? Well the bonds completed their 13 sequential and combo and is now back above risk levels. If anything, we now know that this is very good for mean reversion on the long side in stocks.