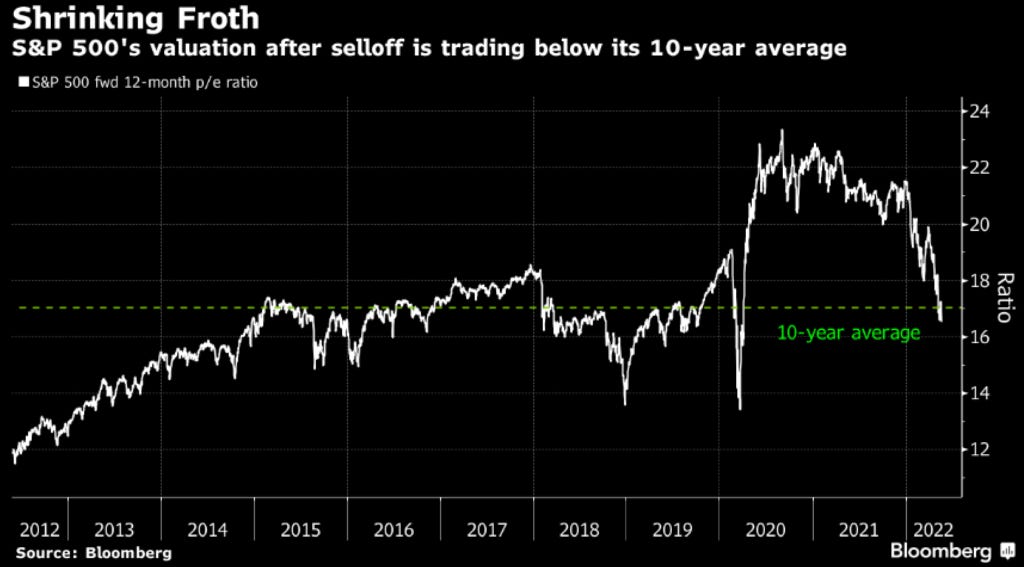

Some Valuations are Now Reasonable

The S&P500 is not insane anymore. Certainly not cheap, but valuations are reasonable, even with higher rates:

Of course, valuations can get a lot lower in a recession. A LOT LOWER. Basically 4X EV/EBITDA is the lower bound for any public company. That's a scary statement because a lot of companies have Debt/EBITDA of 2.5X and if EBITDA were to shrink in …