Well first, let’s cover what happened in markets today. Decent up open via positive NVDA earnings. A full gap fill, followed by a lower low. Basically, a wild outside day.

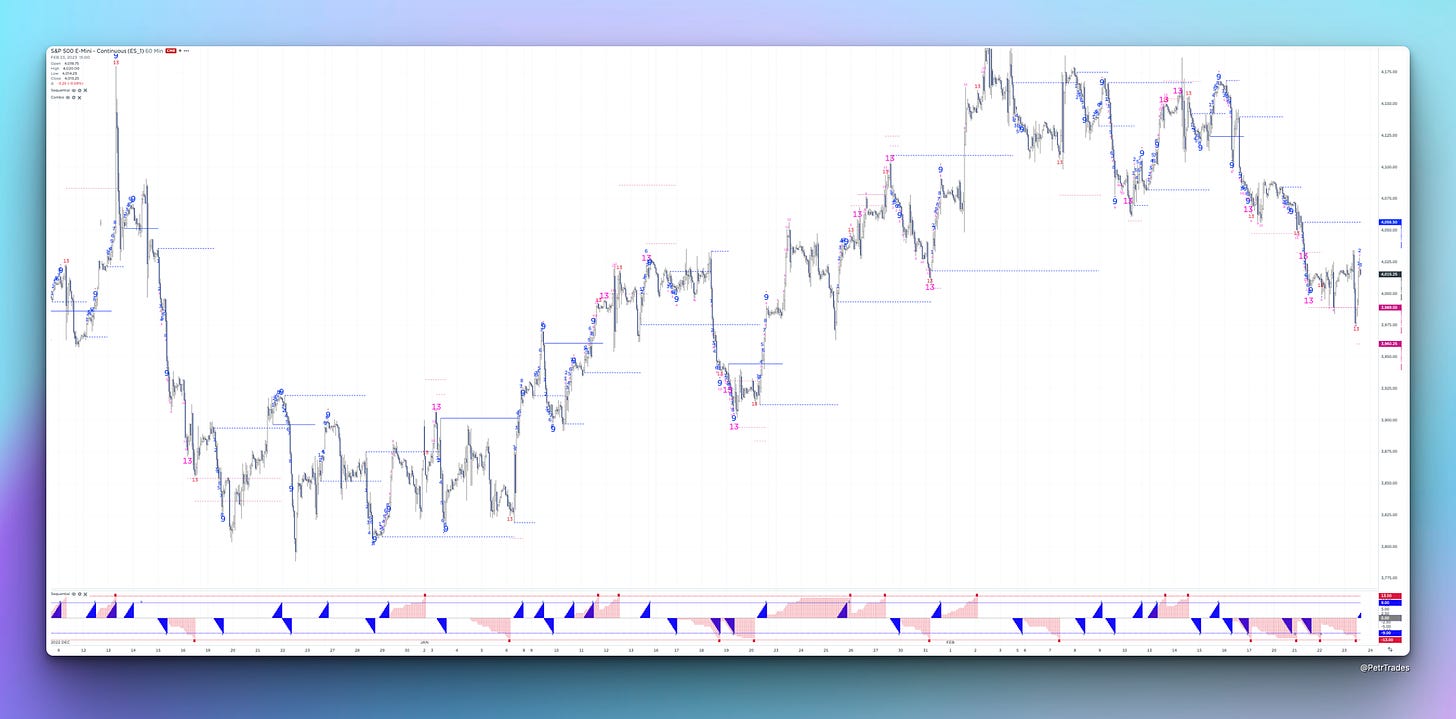

DeMARK 13 Sequential completed on the hourly chart of the S&P 500 March Future at the close. The cash index still has a 13 to complete on the downside, as we qualified a TDST downside …