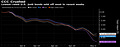

PM Wrap, May 11th, 2022

After a strong morning, the market turned abruptly downward, ending the day down 1%. Crypto continued weak, with BTC breaking below the important $30,000 threshold. Tech in particular had a brutal day:

Apple down (5.1%)

Tesla down (7.9%)

Facebook down (4.5%)

NVDIA down (5.2%)

Netflix down (6.5%)

Companies without cash flow are still getting slaughtered. Carva…