Oh, now the world is bullish.

Did you miss this level on QQQ from Tuesday?

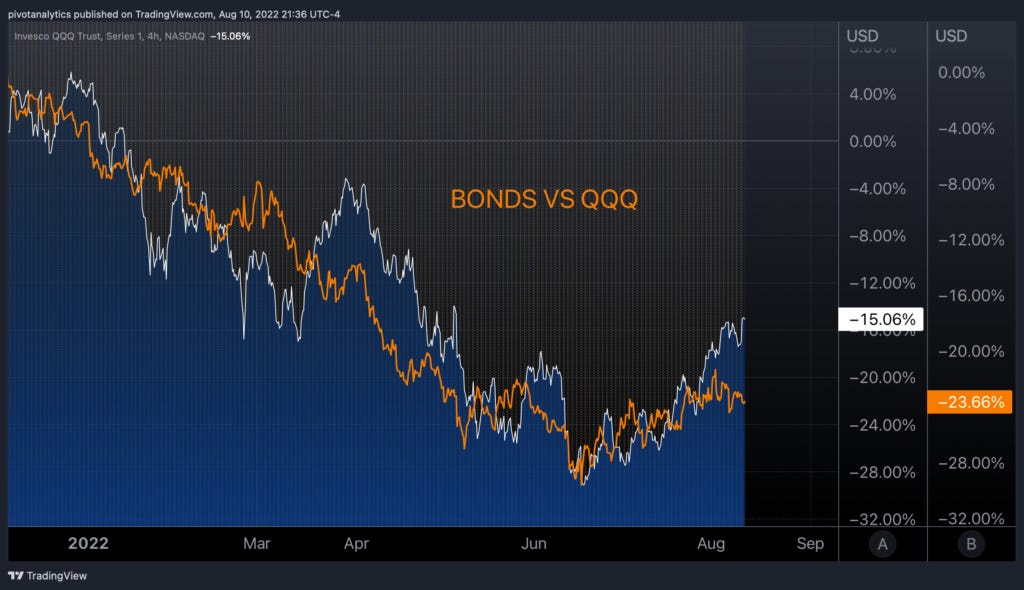

As rates start to creep up a bit, we have to let some exposure go. Why? Just follow this simple idea.

As SPY starts to rear into the 423 level (TD Risk Level from 9 sell), we need to be cautious on the market if the bonds continue to decline. Growth stocks are more sensitive to changes in interest rates than va…