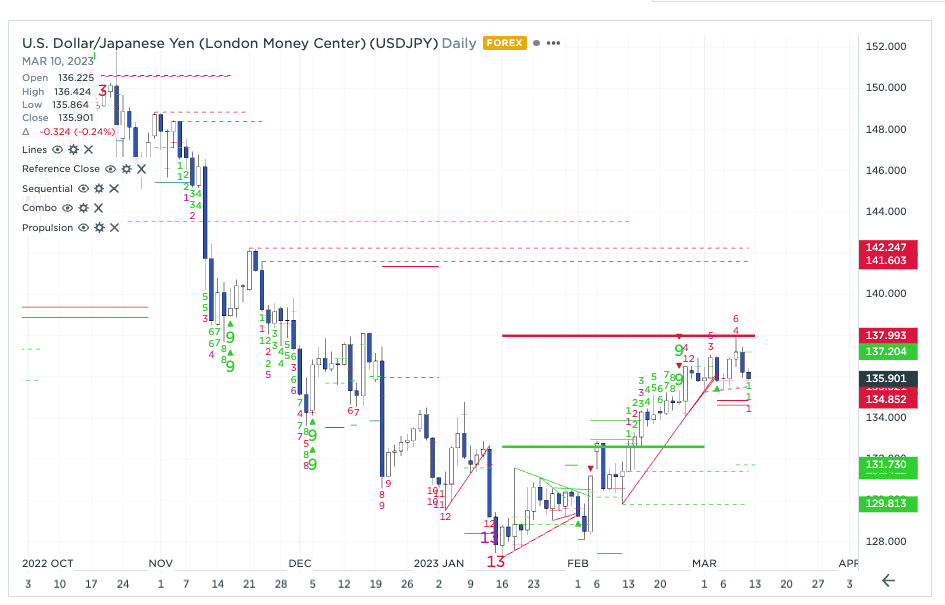

Yen with a DeMark 13 combo on the hourly. Sequential 13 on 30 minute. However, daily chart completed TD Propulsion up. A weaker dollar is welcome now.

Spus remain heavy but if the dollar continues its downside momentum and yields push off into NFP, we have essentially created a short-term cushion into the prior months value area high. We are also now tr…