November is coming to a close as we head into the holiday season. Here are some of the best DeMark setups across the active space right now.

Lets start off with broad markets

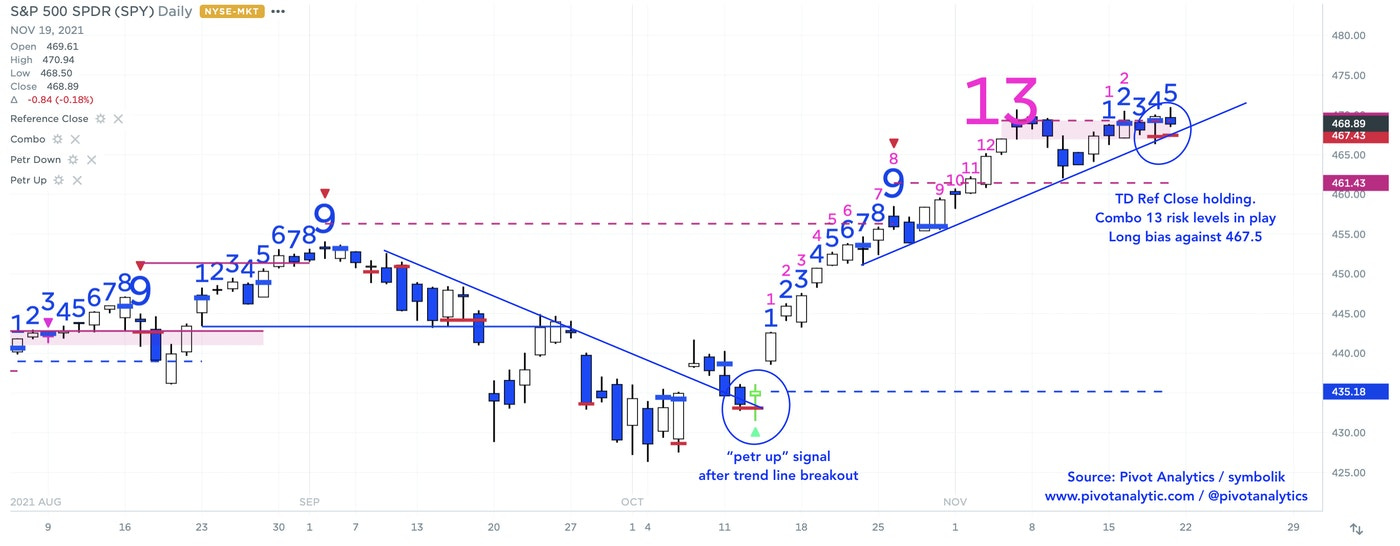

For the S&P, there is really not much bearish action. The last public post we had was when we had the daily TD 9 setup across all markets. Nevertheless, strong tech earnings basically put that to rest.

Names like GOOGL still trading near their highs, of 0.61% from the prior closing high (Thursday). Looking at names like TSLA - would it make sense to short it at 1137? From a conventional chart perspective, the answer is no.

What about the DeMark perspective? Still no.

TSLA failed to stay below TDMA1 (purple line) which it should have defended if it were going lower. Nevertheless, the market failed move lower on several occasions. If it cannot go down, it must go up. Keep it simple with the mentality.

Are large caps like AAPL overbought?

Well, sure. You might expect a down day or two from here. However we just blew past the TD Propulsion exhaustion on both the Tom DeMark "special propulsion" AND regular propulsion. Not bearish price action.

Having said all of that, does fortune favor the bold on volatility longs?

Sure, VXX made a higher low off a TD Sequential 13 countdown and price flip up. The real test will be near 23 which we might be able to get there before Tuesday if we see a breather across large caps. If you start to see VXX trade, hold and close above 23, play the short side for continued volatility.

VGT getting a TD 13 Sell

However, the other DeMark tools say keep it simple and only get confirmed bearish bias on a close below Thursday's low.

Daily buy setup on high yield came in on Friday. It still has a qualified TD Propulsion up to 70 (YVMI)