Here is the full YouTube clip, but below is the text version.

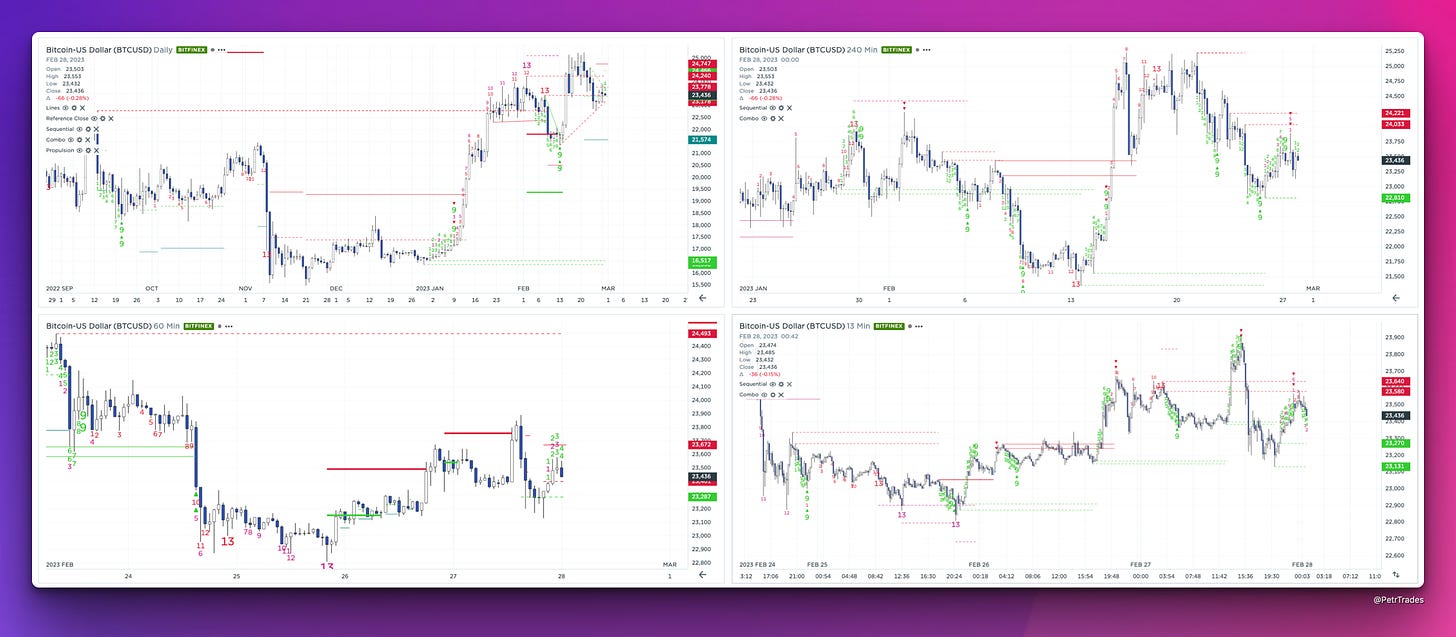

Bitcoin is a short here against the 23,640 area given DeMARK 9 sell setups on short-term time frames along with the 240M. Daily 13 combos all faded risk levels which means the trend has now flipped to the downside.

The Nasdaq failed to qualify TD Propulsion up on the hourly chart and has qualif…