How do you value these Tech Stocks ?

TWLO was down a lot today, and I thought: what do they do? Why is it down so much? What is its conservative value? What price makes sense for a risk averse buyer?

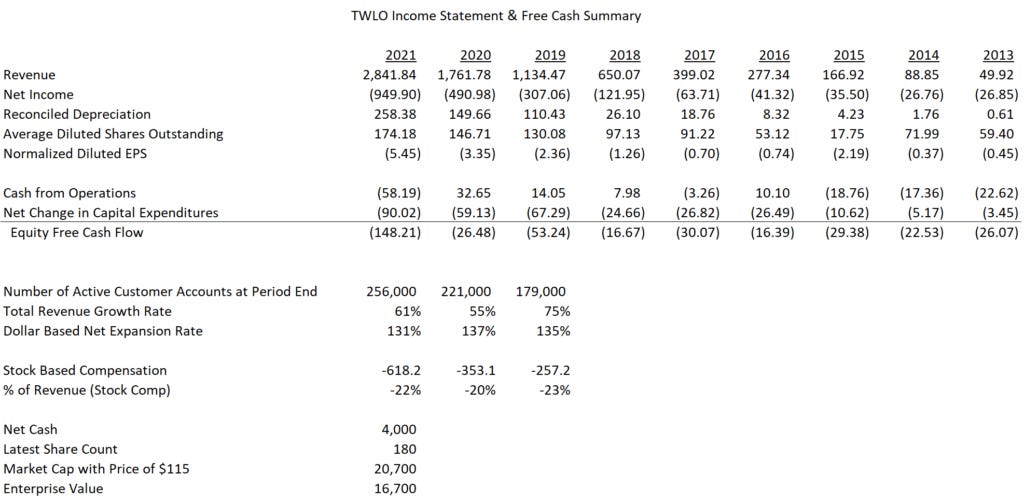

A snapshot of the financial statements shows a great balance sheet and a lot of profitless growth.

TWLO just reported Q1. Kind of breakeven, but who knows? Non-GAAP EPS was breakeven, but down f…