Higher Quality Names DeMARK Scan

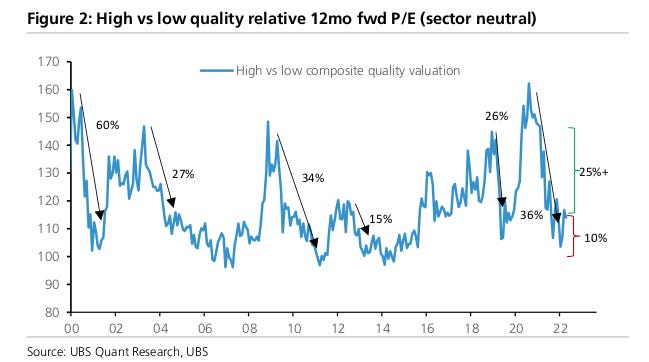

UBS published a note this morning about higher quality names leading the upside on the next phase of the cycle. The charge below shows the 12 month forward earnings of that basket relative to the low quality names.

Below are some of the tickers in that basket with their current market timing counts. Remember, a 13 on the bottom side means downside moment…