Evening Brief

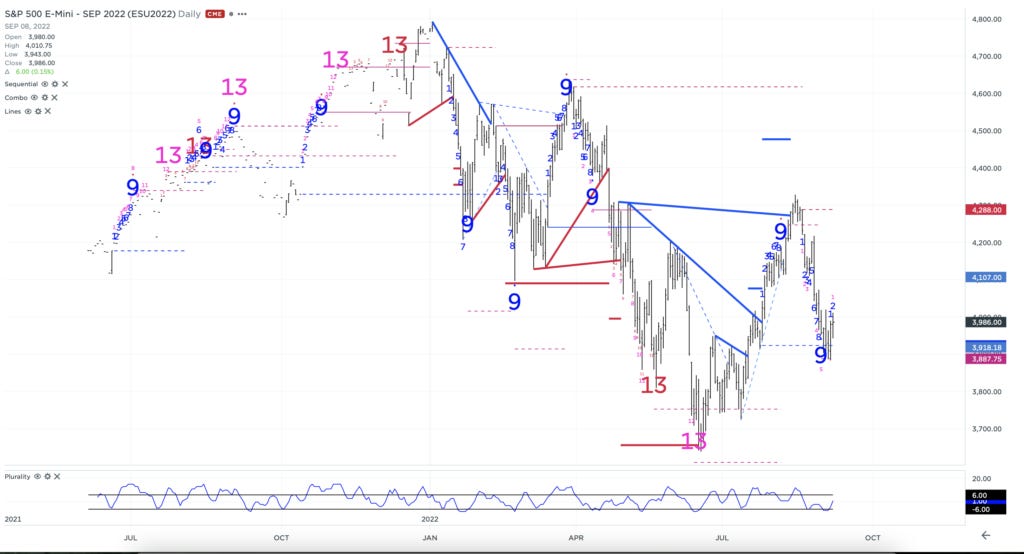

So, the bigger picture gameplay is really starting to come together. We have to keep in mind that we just rallied 3% off a low, so expect some fighting to happen. The nice part is that I don't expect much fighting into tomorrow, a Friday, as I don't think the weekend risk is anywhere near what it was let's say back in May.

Do not believe the narrative th…