Couple Of Plays I'm Eyeing Here Across Tech, Biotech And China

First off, stocks had a really nice rally today on the backdrop of bonds rallying. The gameplay we have been talking about for weeks is still very much in rotation. I would keep it that simple. If the bonds go up on stock weakness, buy stock weakness.

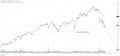

I'm looking at a couple of plays from here that are peaking my interest. Most notably it has to be Faceb…