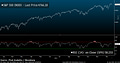

2022: Bull or Bear ?

On November 25th, Bloomberg reported that 2021 inflows to ETFs and long-only funds was approximately $0.9 Trillion, exceeding the combined total of the previous 19 years! By year end, the number had exceeded $1 Trillion in stock market inflows, mostly into ETFs. Wow. Make your own call but its generally not profitable to try and c…